In 2025, financial relief programs and stimulus payments continue to play a big role in helping individuals and families recover from economic challenges. Unfortunately, scammers are taking advantage of this by creating fake stimulus payment schemes that look convincing but are designed to steal your money or personal information.

If you’ve received a message, call, or email promising a “new government stimulus check,” it’s time to be cautious. In this guide, we’ll uncover the top stimulus scams to watch out for in 2025, how to recognize them, and most importantly—how to protect yourself from falling victim.

Understanding Stimulus Scams in 2025

Stimulus scams are deceptive schemes where fraudsters pretend to represent government agencies like the IRS, Social Security Administration, or local welfare departments. They lure victims with fake promises of new payments, bonuses, or “urgent updates” about financial aid.

The scammers’ main goal is to steal personal information, including your Social Security number, bank account details, or login credentials. Some even send fake checks or text messages that look almost identical to official communications.

These scams evolve every year, and in 2025, they’re more sophisticated than ever—with scammers using AI-generated messages, fake websites, and cloned phone numbers to make their traps look real.

1. Fake Stimulus Check Emails

One of the most common scams in 2025 involves emails claiming you’ve been approved for a new stimulus payment. These emails often contain official-looking logos, such as those of the IRS or Treasury Department, and instruct you to “verify your details” to receive your check.

Warning signs include:

- Urgent subject lines like “Claim Your Stimulus Now” or “Final Notice: Payment Expiring.”

- Requests for personal or banking information.

- Suspicious links that lead to fake government websites.

What to do:

Never click on links or open attachments in unsolicited emails. The IRS and other legitimate agencies never send payment confirmation emails. Always visit IRS.gov or official government websites directly to verify information.

2. Phishing Text Messages

Another popular scam spreading in 2025 involves text messages promising quick payments or bonus relief funds. These messages usually say you’re eligible for a new round of stimulus and ask you to tap a link to claim your payment.

Once you click, you’re taken to a fake site that steals your identity or downloads malware onto your phone.

Example of a scam message:

- “You have been selected for a new $1,200 government stimulus payment. Click here to verify your eligibility: www.stimulus-verify2025.com.”

What to do:

Delete the message immediately. Legitimate government agencies will never send payment offers via SMS. Report such scams to your country’s cybercrime division or consumer protection agency.

3. Fake Social Media Pages and Ads

Scammers now use Facebook, Instagram, and X (formerly Twitter) to promote fake stimulus programs. They often run ads that look official, promising “instant government payments” or “new 2025 economic relief checks.”

Once you click on the ad, you may be directed to a phishing site or asked to pay a “processing fee” to receive your check.

What to look for:

- Pages with low follower counts or no verification badge.

- Poor grammar or spelling errors in posts.

- Comments sections filled with bots or suspicious testimonials.

What to do:

Only trust verified government social media accounts. Real agencies do not use social media ads to offer or confirm stimulus payments.

4. Phone Call Impersonation Scams

Scammers often pose as government officials or tax representatives over the phone. They claim that you owe money or need to confirm details to receive your payment.

They might even spoof official numbers, making it seem like the call is coming from the IRS, Centrelink, or another government office.

Common tactics include:

- Threatening arrest or penalties if you don’t act immediately.

- Asking you to pay “release fees” for your stimulus check.

- Requesting verification of your Social Security number.

What to do:

Hang up immediately. Government agencies will never demand payment or sensitive details over the phone. If you’re unsure, call the agency directly using their official number.

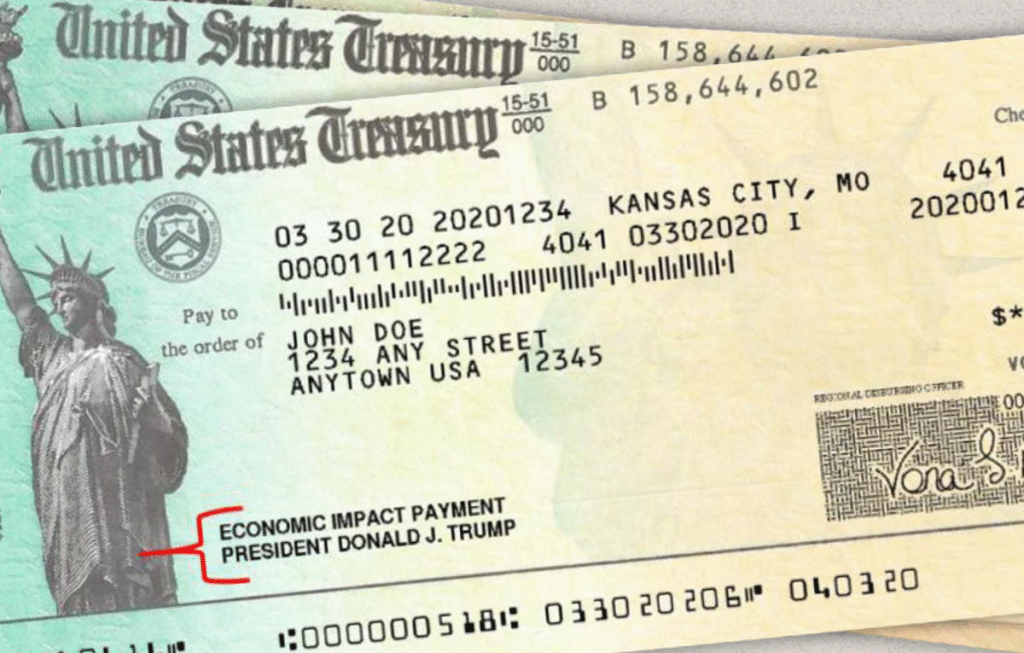

5. Fake Stimulus Check Mail Scams

Some fraudsters send fake physical checks by mail that look real, complete with government seals and watermarks. They may include a letter instructing you to “deposit the check and send part of it back” to cover taxes or fees. After you deposit it, the check bounces—and you lose the money you sent back.

What to do:

Never cash a check from an unknown sender. Always verify the check through your bank or the issuing agency before making any transactions.

6. Impersonation on WhatsApp and Messaging Apps

With messaging apps being so common, scammers have started impersonating government representatives on WhatsApp, Telegram, and Messenger.

They send messages like:

- “We’re processing your new $1,500 stimulus grant. Please confirm your name and ID to receive funds.”

- Once you respond, they gather your personal data or demand small “registration fees.”

What to do:

Ignore and block these numbers. Legitimate agencies never use private messaging apps for official communication.

7. Advance Fee Stimulus Scam

Some scams ask you to pay a small fee upfront to “speed up processing” or “release your funds.” The scammer may say the payment covers taxes, paperwork, or administrative costs—but once you send the money, they disappear.

What to do:

Never send money to receive money. Government programs never require pre-payment for any stimulus, pension, or welfare benefits.

8. Fake Application Websites

Scammers now create fake government portals that mimic official websites with URLs that look nearly identical (like gov-relief2025.org instead of gov.au or gov.za). They ask for full personal and banking details to “confirm eligibility.”

How to spot fake sites:

- URLs with extra words or numbers.

- Missing SSL certificate (no lock icon in the browser).

- Pop-ups asking for private information.

What to do:

Always manually type official web addresses or access them through known links from verified government announcements.

9. Stimulus Scam Emails in Business Names

Fraudsters have also started targeting small business owners with emails claiming to offer “stimulus for business recovery.” They promise fast funding but require sensitive information or “application fees.” Once the details are given, scammers can drain business accounts or misuse company data.

What to do:

Verify any business relief program directly through the government’s small business portal or a trusted financial institution.

10. Cryptocurrency Stimulus Scams

As crypto use grows, scammers claim that new stimulus payments will be made in cryptocurrency to appear modern and tech-savvy. They’ll ask you to provide a crypto wallet address or even send money upfront for “activation.”

What to do:

No government agency distributes stimulus funds in cryptocurrency. Avoid sharing wallet details or transferring digital assets in response to such offers.

How to Protect Yourself from Stimulus Scams

- Verify the Source: Always double-check messages or emails through official government websites.

- Avoid Clicking Links: Type web addresses manually instead of clicking links in messages.

- Don’t Share Personal Info: Never reveal your ID, banking, or tax details unless on a verified portal.

- Enable Two-Factor Authentication: Protect online accounts with added security layers.

- Report Suspicious Activity: Contact your national fraud reporting center or cybercrime helpline.

What to Do If You’ve Been Scammed

If you suspect you’ve fallen victim to a stimulus scam:

- Contact your bank immediately to freeze or monitor your accounts.

- Change all passwords on your online accounts.

- Report the scam to your country’s fraud protection agency (e.g., FTC.gov, ACCC, or SAPS Cybercrime Unit).

- Check your credit report for unusual activity or identity theft.

- Stay alert for future scams—victims are often targeted again.

Why Stimulus Scams Are Rising in 2025

Scammers thrive on uncertainty. With the global economy still adjusting to inflation, cost-of-living increases, and ongoing digitalization, people are more vulnerable to financial traps.

The combination of desperation, misinformation, and technology has made it easier for scammers to reach thousands of victims in seconds. That’s why staying informed and cautious is your best protection.

Conclusion

Stimulus payments are meant to provide financial relief—but scammers see them as opportunities for exploitation. In 2025, fake emails, texts, phone calls, and websites have made it harder to tell real from fake.

Remember: The government will never ask for money, personal details, or banking information via phone, text, or social media. Always verify any stimulus news directly from official government websites and avoid clicking unknown links.

FAQs:-

What are stimulus scams in 2025?

Stimulus scams are fake messages, emails, or calls pretending to offer government payments to steal your personal or banking details.

What’s the most common type of stimulus scam?

Fake check offers and phishing links that ask for your Social Security number or bank information are the most common.

How can I verify if a stimulus offer is real?

Always check official websites like or your government’s verified communication channels.