Why rare coins still attract big money in 2025

The rare-coin market is showing robust strength: ultra-rare U.S. and world coins continue to fetch multi-million-dollar prices at auction. Key drivers include:

- Historically significant pieces (first of their kind, or linked to major events)

- Very low survival numbers or tiny mintages

- Premium grades (high condition) certified by respected grading services

- Global collectors and investors looking for “hard assets” outside stocks/bonds

- The interplay of bullion value (e.g., gold) plus numismatic premium

Below are ten coins you’ll often see on “million-dollar” or high-value lists for 2025. They’re ordered roughly from the most expensive/legendary downward — but “top 10” is subjective and many variations exist.

1. 1933 Saint-Gaudens Double Eagle (U.S. $20 gold coin)

Why it’s special: This gold coin was struck in 1933 but almost all were melted when the U.S. shifted off the gold standard. Only a few are legally in private hands.

Recent value: One example sold for around US$18.9 million in 2021.

Investment note: With such top-tier rarity, it’s a trophy piece — not accessible for most investors. Only a handful of specimens will ever appear.

2. 1794 Flowing Hair Silver Dollar (U.S.)

Why it’s special: Widely considered the first silver dollar struck by the U.S. Mint. The historical significance adds enormous premium.

Value estimates: Some examples have sold for $7–10 million or more.

Takeaway: If one surfaces in top grade, it commands attention. But again, extremely limited supply.

3. 1804 Silver Dollar (U.S.)

Why it’s special: Known as “King of American Coins.” Though dated 1804, many were struck later as presentation pieces/gifts. Only about 15 genuine specimens exist across the classes.

Value: Estimates in 2025 suggest $7.5–$9 million or more for prime examples.

Note: Its rarity and mythic status keep it on top-tier wish-lists.

4. 1913 Liberty Head Nickel (U.S.)

Why it’s special: Only five are known to exist, and the story (secret minting) adds intrigue.

2025 outlook: Some estimates point toward $5 million or more for high-grade examples.

Caveat: You’re very unlikely to discover one — this is ultra-rare.

5. 1894-S Barber Dime (U.S.)

Why it’s special: Minted at San Francisco, with just 24 pieces made and very few survive.

Value: Historic sales show ~$1.9 million in earlier years; 2025 could push higher.

Note: This is a top “key date” among dime collectors; still somewhat more accessible than the top gold-coins, but still rare.

6. 1943 Bronze Wheat Penny (U.S.)

Why it’s special: During WWII most pennies were steel (to save copper). A few were mistakenly struck in bronze. These error coins are extremely rare.

Value: Some 2025 reports suggest $1.7–$2 million for a top specimen.

Takeaway: Though the face value is just one cent, the error makes it a potential high-end collectible.

7. 1927-D Saint-Gaudens Double Eagle (U.S.)

Why it’s special: A gold coin minted at Denver, with exceptionally low mintage of high-grade survivors.

Value: Estimates in excess of $1.2 million or more for strong examples.

Note: This coin combines bullion value (gold) with numismatic premium.

8. 1955 Doubled Die Lincoln Cent (U.S.)

Why it’s special: A major mint error where the date and lettering are doubled. A key piece for Lincoln cent collectors.

Value: Many examples sell in the six-figure range; estimated $50,000–$100,000 for certain grades in 2025.

Note: More “accessible” compared to multi-million coins, but still big money.

9. 1907 Indian Head Eagle ($10 gold) (U.S.)

Why it’s special: Part of the Indian Head Eagle series (1907–1933) with key dates and limited survivorship.

Value range: The series offers some “entry” points and some high-tier pieces, making it interesting for serious investors.

Takeaway: Not as flashy as the top 5, but strong fundamentals for those building a collection/investment.

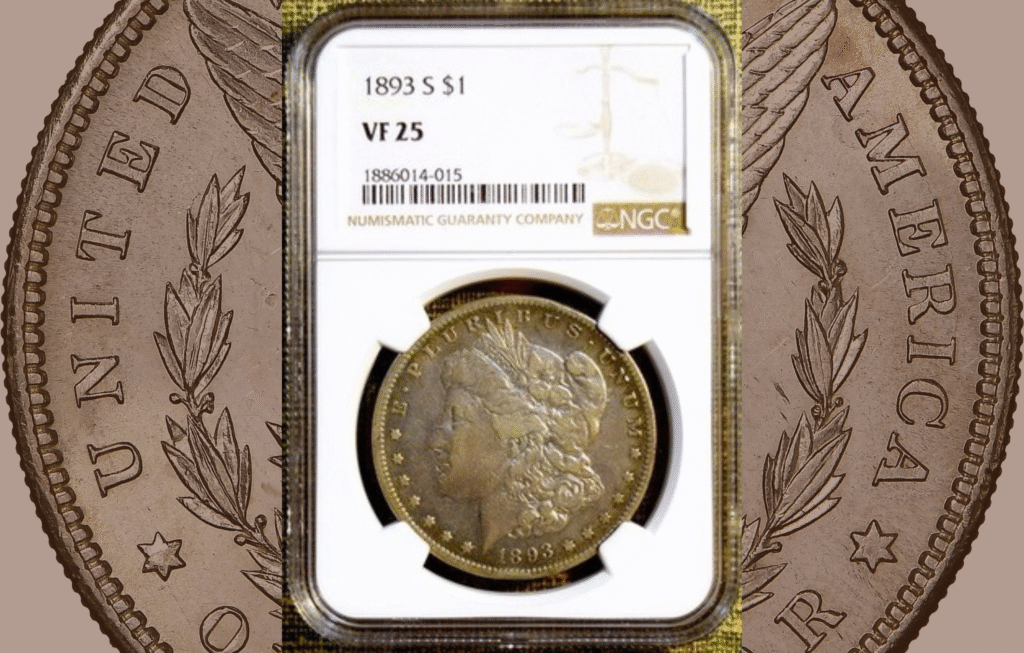

10. 1893-S Morgan Silver Dollar (U.S.)

Why it’s special: Among Morgan dollars, the 1893‑S is a key date due to low mintage and high demand.

Value: While not always multi-million, high-grade examples command very strong premiums and are considered excellent long-term plays.

Note: For investors with more modest budgets, this kind of coin may be more realistic yet still valuable.

Key Investment Considerations

If you’re thinking about rare coins as “million-dollar treasures,” here are important factors to weigh:

- Condition (grade): A top-grade specimen (e.g., MS65, MS67) can sell for exponentially more than the same coin in poor condition.

- Certification: Coins graded/certified by PCGS, NGC (and similar) carry higher trust & value.

- Provenance & authenticity: Rarity plus documented history add premium; fakes are a real concern.

- Survivorship: How many exist, and how many are in high condition? The fewer, the better for value.

- Historical significance: Coins tied to major events, or “firsts/lasts,” often outperform.

- Market demand: It’s not enough to be rare — there must be active demand among collectors/investors.

- Liquidity & costs: Expect high premiums, auction fees, storage/security costs, authenticity risk.

- Diversification: Even within coins, don’t rely on a single piece; diversify across dates, types, metals.

- Long-term mindset: Coin markets often move slowly; impatience may reduce returns. “Investors should focus on long-term trends rather than short-term price movements.”

- Exit strategy: Know how you’ll sell or monetize the coin in future — auction house, dealer, private sale.

Market Trends in 2025

- Auctions continue setting new records. For example, an auction event in early 2025 delivered over US$65.4 million in total rare-coin sales.

- Global demand is increasing — Latin American coins and world coins are drawing attention, not just U.S. rarities.

- Error coins (like the 1943 Bronze Penny) and key-date “budget” rarities are seeing significant interest as entry points.

- Bullion value (e.g., gold coins) can provide a baseline “floor,” but true value comes from the numismatic premium.

- Condition scarcity matters more than ever: two coins of the same date might differ greatly in value based solely on grade and eye appeal.

Final Thoughts

If your goal is to invest with the hope of a “million-dollar coin,” the coins listed above represent the caliber of pieces collectors hunt. But remember: few million-dollar coins can be obtained, and prices for lesser grades may still run into high six-figures.

For many investors, a realistic strategy might be:

- Acquire a rare high-quality coin in a slightly lower “tier” (key date, but not unique)

- Ensure certification and sound provenance

- Hold for the long term and monitor market trends rather than expect quick flips

FAQs

Why are rare coins valuable in 2025?

Rare coins combine historical significance, low mintage, high-grade condition, and growing collector demand. Many see them as tangible, appreciating assets outside traditional markets.

What’s the most expensive U.S. coin in 2025?

The 1933 Saint-Gaudens Double Eagle is the most iconic, with one selling for nearly $19 million. It’s valued for rarity, history, and legal ownership scarcity.

What makes the 1794 Flowing Hair Dollar special?

It’s believed to be the first silver dollar struck by the U.S. Mint. Its early American heritage and limited surviving examples push values to $10 million.